In the world of commercial real estate, accurate property valuation is critical for investors, lenders, and businesses. Commercial real estate appraisal provides a professional estimate of a property’s market value, ensuring informed decision-making for purchases, sales, refinancing, or taxation purposes. Unlike residential properties, commercial properties involve complex factors such as income potential, zoning regulations, and business viability, making professional appraisal indispensable.

A commercial real estate appraisal is a formal, unbiased assessment of a commercial property’s value conducted by a licensed appraiser. This includes office buildings, retail centers, warehouses, hotels, and industrial facilities.

Appraisers consider several factors such as:

Location and surrounding business environment

Property size, layout, and design

Income potential from tenants

Market trends and comparable sales

Legal and zoning compliance

The primary goal is to determine market value, which is crucial for financing, investment analysis, insurance, and tax purposes.

📞 Call/WhatsApp: +1 (561) 600-4443

📧 Email: info@backbonedatasolutions.com

🌐 Website: Visit Backbone Data Solution

Commercial property appraisal is essential for multiple stakeholders:

For Investors: Helps assess the return on investment and risks.

For Lenders: Protects banks by ensuring loans are secured against accurate property values.

For Business Owners: Determines fair pricing when buying, selling, or leasing commercial spaces.

For Tax Authorities: Assists in proper taxation based on property value.

Without an appraisal, stakeholders may face financial losses, overpay for properties, or make poor investment decisions.

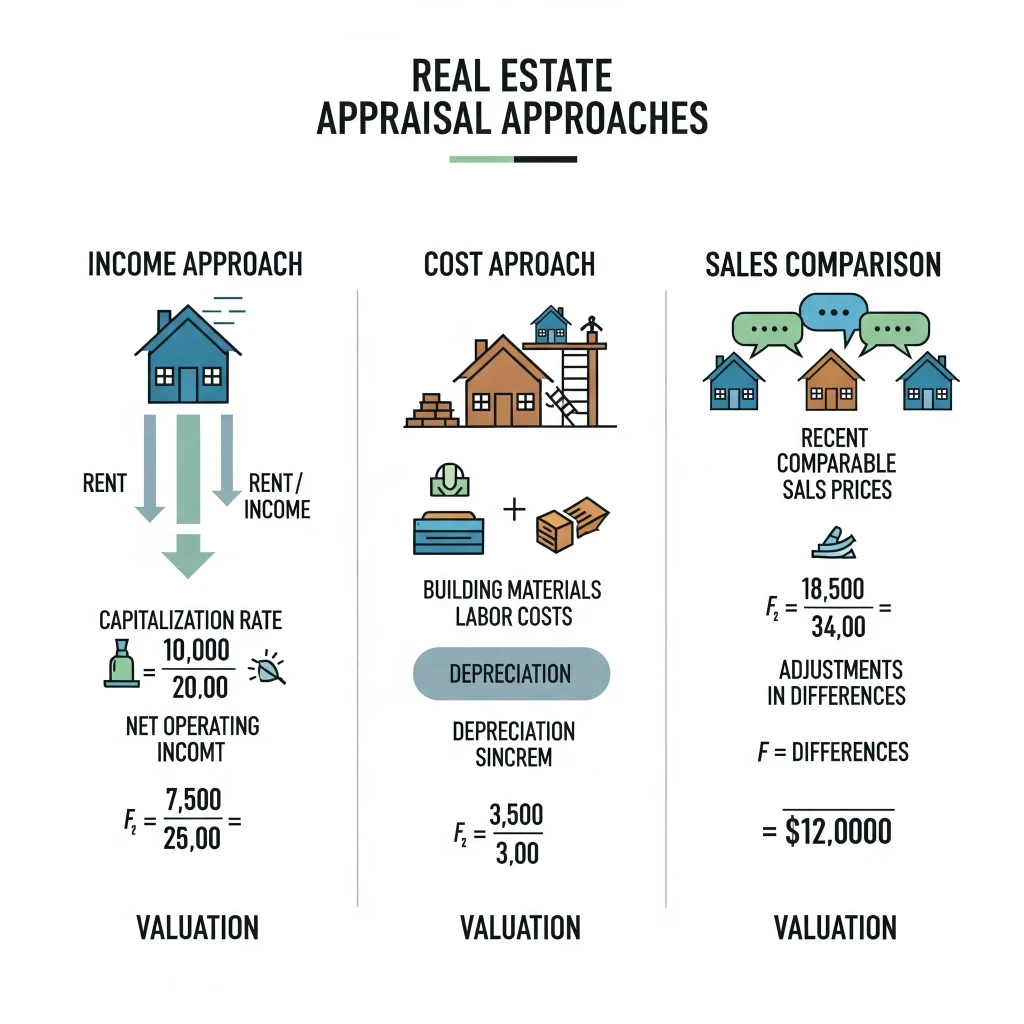

Income Approach: Evaluates value based on rental income and potential cash flow.

Cost Approach: Calculates value based on the cost to replace or rebuild the property minus depreciation.

Sales Comparison Approach: Compares the property with similar commercial properties recently sold in the market.

Each method suits different property types and transaction goals. Often, appraisers use a combination of these approaches to ensure accurate valuation.

The appraiser inspects the property’s exterior and interior, noting details like square footage, condition, structural integrity, and unique features.

Analyzing the local commercial real estate market, recent sales, lease rates, and trends helps determine a fair market value.

If the property generates income, the appraiser reviews rental contracts, operating expenses, and potential revenue streams.

A detailed appraisal report is prepared, including property description, valuation approach, supporting data, and final market value.

The final report is submitted to clients, lenders, or investors, providing a professional basis for decisions regarding buying, selling, refinancing, or insurance.

Location: Proximity to transport, business hubs, and demographics.

Property Type: Offices, retail, industrial, or hospitality properties have different valuation criteria.

Income Potential: Rent rolls, occupancy rates, and tenant quality affect appraisal value.

Condition & Age: Well-maintained or recently renovated properties are valued higher.

Market Trends: Economic factors, demand-supply ratio, and industry growth impact commercial property value.

Zoning & Legal Compliance: Properties compliant with local regulations have higher market acceptance.

Businesses and property owners can take steps to maximize appraisal value:

Maintain Property: Fix structural issues, update facilities, and maintain cleanliness.

Provide Documentation: Lease agreements, maintenance records, and income statements.

Highlight Upgrades: Showcase renovations, energy-efficient installations, or added amenities.

Improve Curb Appeal: Exterior aesthetics impact perceived value.

Ensure Accessibility: Appraisers should have access to all areas, including storage, basements, and rooftop utilities.

Accurate Market Value: Helps buyers, sellers, and investors make informed decisions.

Loan Approval & Refinancing: Critical for securing commercial financing.

Investment Analysis: Determines ROI and financial feasibility for commercial projects.

Negotiation Advantage: Provides a strong basis for price negotiations.

Insurance & Tax Purposes: Ensures proper insurance coverage and tax assessment.

We value every inquiry and understand that your time is important. Whether you have a question about our services, need more details before making a decision, or simply want to share your feedback, our team is always ready to assist you. Our goal is to provide clear, prompt, and helpful responses so that you feel supported at every step.

Send us a message and we will respond as quickly as possible. Our team is always ready to assist you with queries, guidance, or support so that you receive the right information without any delay.

With the rise of PropTech (Property Technology), appraisal companies are integrating:

AI & Big Data Analytics for faster valuations.

Online Valuation Tools for preliminary reports.

Drone Inspections for large properties.

Blockchain Integration for transparent property records.

The industry is moving toward more accurate, data-driven, and efficient valuations to match the speed of today’s real estate market.