Real estate valuation is not a one-size-fits-all process. Every property has unique characteristics, market conditions, and financial factors that influence its worth. This is why professional appraisal firms rely on real estate valuation approaches rather than a single method.

Using multiple valuation approaches allows appraisal companies to deliver fair, accurate, and legally defensible property values. These methods help lenders, buyers, sellers, investors, and courts make informed decisions with confidence.

In this blog, we’ll explain why real estate appraisal companies use multiple valuation approaches, how each method works, and when they are applied.

What Are Real Estate Valuation Approaches?

Real estate valuation approaches are professional methods used by appraisers to estimate a property’s market value by analyzing market data, income potential, and replacement costs

The three primary real estate valuation approaches are:

- Sales Comparison Approach

- Cost Approach

- Income Approach

Each approach serves a specific purpose depending on the property type and valuation objective.

Why One Valuation Method Is Not Enough

Relying on just one valuation method can lead to inaccurate results. Market fluctuations, property uniqueness, and financial performance vary widely.

Using multiple real estate valuation approaches helps appraisal companies:

- Cross-check property values

- Reduce valuation bias

- Improve accuracy

- Meet lender and legal requirements

- Support complex real estate decisions

This layered approach ensures consistency and reliability.

1. Sales Comparison Approach: Reflecting Market Behavior

The Sales Comparison Approach is one of the most commonly used real estate valuation approaches, especially for residential properties.

How It Works:

- Compares the subject property with recently sold similar properties

- Adjusts value based on size, location, condition, and features

- Reflects real buyer behavior in the market

Best Used For:

- Single-family homes

- Condos and townhouses

- Active residential markets

Why Appraisers Use It:

It shows what buyers are actually willing to pay, making it highly relevant for market-based valuations.

2. Cost Approach: Understanding Replacement Value

The Cost Approach estimates what it would cost to rebuild the property today, minus depreciation.

How It Works:

- Calculates land value

- Adds current construction cost

- Subtracts depreciation (wear, age, obsolescence)

Best Used For:

- New or recently built properties

- Special-use buildings (schools, hospitals, churches)

- Insurance and legal valuations

Among all real estate valuation approaches, this method is essential when comparable sales are limited.

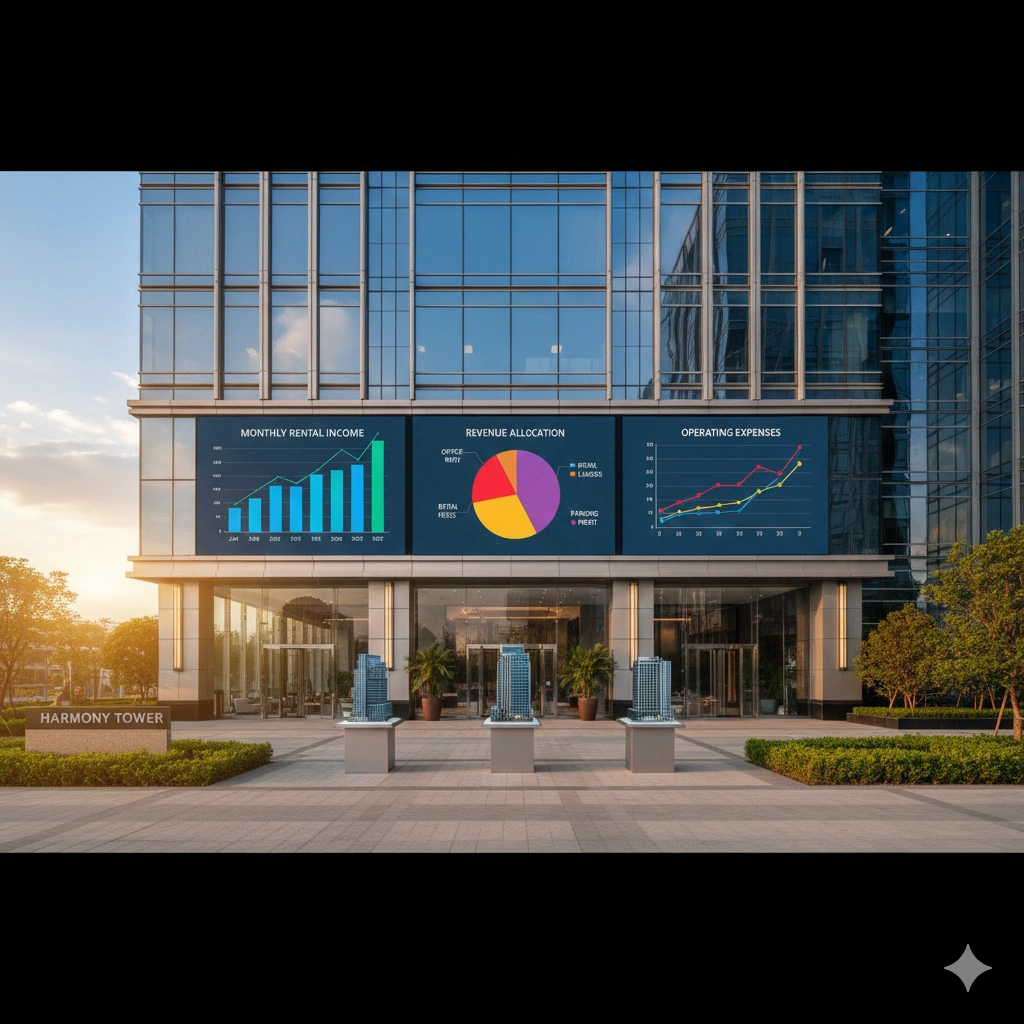

3. Income Approach: Valuing Income Potential

The Income Approach focuses on a property’s ability to generate income.

How It Works:

- Analyzes rental income

- Calculates operating expenses

- Applies capitalization rate (cap rate)

Best Used For:

- Rental properties

- Apartment complexes

- Office buildings

- Retail and industrial properties

This is one of the most critical real estate valuation approaches for investors and lenders evaluating cash flow.

Why Appraisal Companies Combine Multiple Approaches

Professional appraisers rarely rely on just one method. Instead, they use multiple real estate valuation approaches to confirm accuracy.

Key Reasons:

- Market data may be limited or outdated

- Income projections may vary

- Construction costs fluctuate

- Property purpose differs (sale, refinance, legal case)

Combining approaches provides a balanced, well-supported final value.

How Valuation Approaches Vary by Property Type

| Property Type | Primary Valuation Approach |

|---|---|

| Residential Homes | Sales Comparison |

| Rental Properties | Income Approach |

| Commercial Buildings | Income + Sales |

| New Construction | Cost Approach |

| Special-Purpose Property | Cost Approach |

Professional appraisal firms choose real estate valuation approaches based on property use, not guesswork.

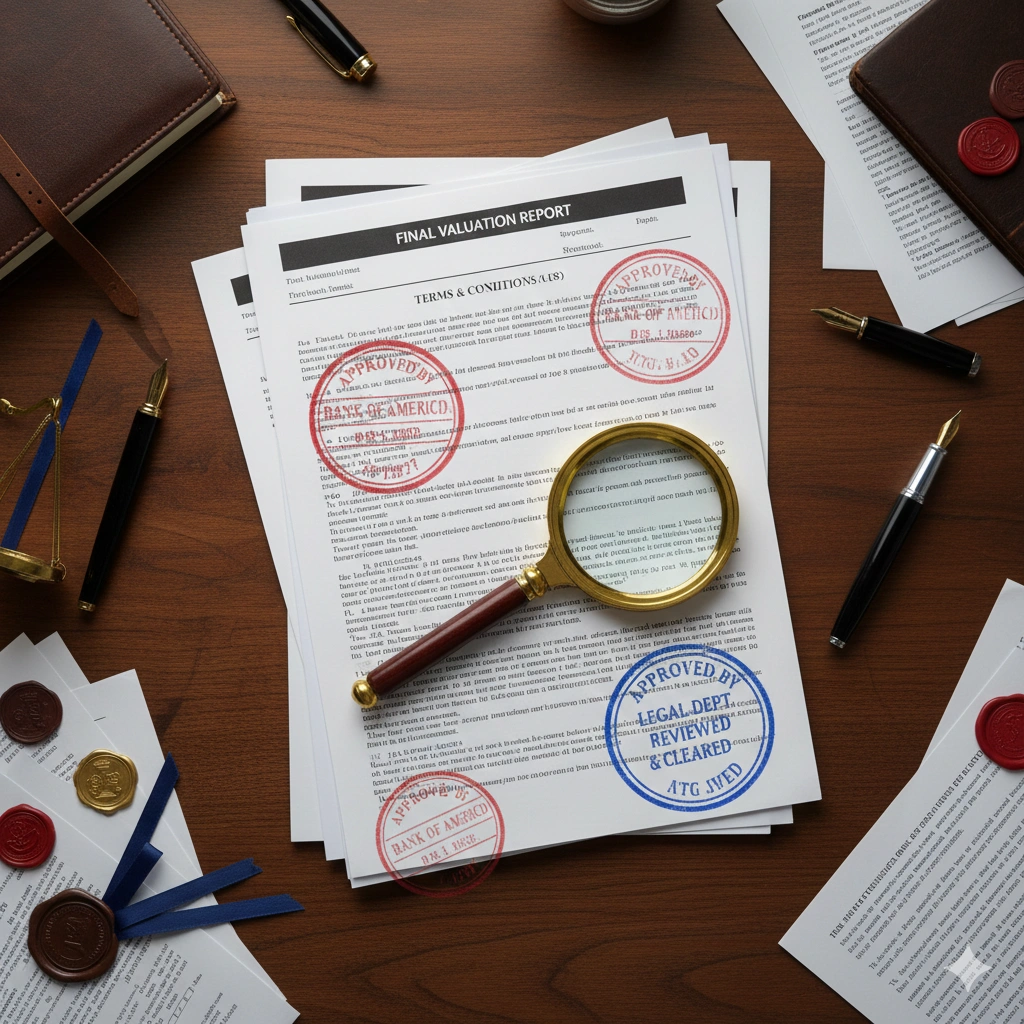

Meeting Lender, Legal & Regulatory Requirements

Banks, courts, and government agencies require well-supported valuations. Using multiple real estate valuation approaches helps appraisal companies:

- Meet USPAP standards

- Support mortgage underwriting

- Defend values in court

- Handle divorce, probate, and tax appeals

A single method is often not enough for compliance.

Reducing Risk and Valuation Disputes

Disputes often arise when property values are questioned. Using several real estate valuation approaches strengthens credibility and minimizes disagreement.

Benefits:

- Fewer appraisal challenges

- Stronger negotiation support

- Better decision-making for buyers and sellers

This is especially important in high-value or contested transactions.

Technology’s Role in Modern Valuation Approaches

Modern appraisal companies use:

- Automated valuation models (AVMs)

- Market analytics tools

- Geographic data systems (GIS)

Technology enhances traditional real estate valuation approaches, improving precision and speed.

Frequently Asked Questions

1. Why do appraisers use more than one valuation approach?

Short Answer: To ensure accuracy, reliability, and compliance with professional standards.

2. Are all valuation approaches used in every appraisal?

Short Answer: No. Appraisers select the most relevant real estate valuation approaches based on the property type and purpose.

3. Which approach is the most accurate?

Short Answer: Accuracy improves when multiple approaches support a similar value conclusion.

4. Do lenders require multiple valuation methods?

Short Answer: Often yes, especially for complex or high-value properties.

Using multiple real estate valuation approaches is a professional necessity, not an option. It ensures property values are fair, defensible, and aligned with real-world conditions.

Whether for buying, selling, investing, or legal purposes, multiple valuation approaches provide clarity, confidence, and trust in every real estate decision.

Author: Mangesh

Last Updated: December 2025

Category: Real Estate Appraisal & Valuation

Follow Us: facebook.com | instagram.com | linkedin.com | BackBoneDataSolutions.com