Outsourcing billing is a major step for any healthcare practice. Whether you’re a solo practitioner, clinic, or multi-specialty group, the first 90 days with a medical billing company set the foundation for long-term financial health, smoother operations, and improved cash flow.

Many providers feel uncertain during this transition. What happens first? How long before results appear? What changes should you expect?

This guide explains everything clearly—step by step—so you know exactly what to expect, how to prepare, and how to measure success during the first three months.

Why the First 90 Days Matter So Much

The first 90 days with a medical billing company focus on onboarding, system setup, claim cleanup, workflow optimization, and establishing performance benchmarks.

The first three months are not just about submitting claims. They are about fixing past issues, building accurate processes, and aligning billing with payer rules.

During this phase, the billing company learns:

- Your specialty workflows

- Your payer mix

- Common denial reasons

- Coding patterns

- Revenue bottlenecks

At the same time, your practice begins to experience structured billing operations.

Phase 1: Days 1–30 – Onboarding & Data Transition

The first month of the first 90 days with a medical billing company is all about setup and understanding.

Key Activities in Days 1–30

- Secure transfer of patient and billing data

- Access to EHR, PM software, and clearinghouses

- Signing Business Associate Agreements (BAA)

- Review of payer contracts and fee schedules

- Credential verification (if required)

What You May Notice

- Slower billing at first (this is normal)

- Many questions from the billing team

- Deep review of your previous claims

This phase ensures accuracy before volume.

Claim Audit & Revenue Assessment

Most medical billing companies start the first 90 days with a medical billing company by auditing your past claims.

They Evaluate

- Denied and unpaid claims

- Coding accuracy

- Missing modifiers

- Eligibility errors

- Underpayments

This process often reveals hidden revenue leaks that were previously unnoticed.

“Many practices recover lost revenue in the first 90 days simply by correcting old errors.”

Phase 2: Days 31–60 – Process Optimization & Clean Claim Focus

This stage is where improvements become visible.

What Happens During Days 31–60

- Standardized billing workflows are applied

- Coding guidelines are enforced

- Eligibility checks become routine

- Claims are scrubbed before submission

- Denial prevention strategies begin

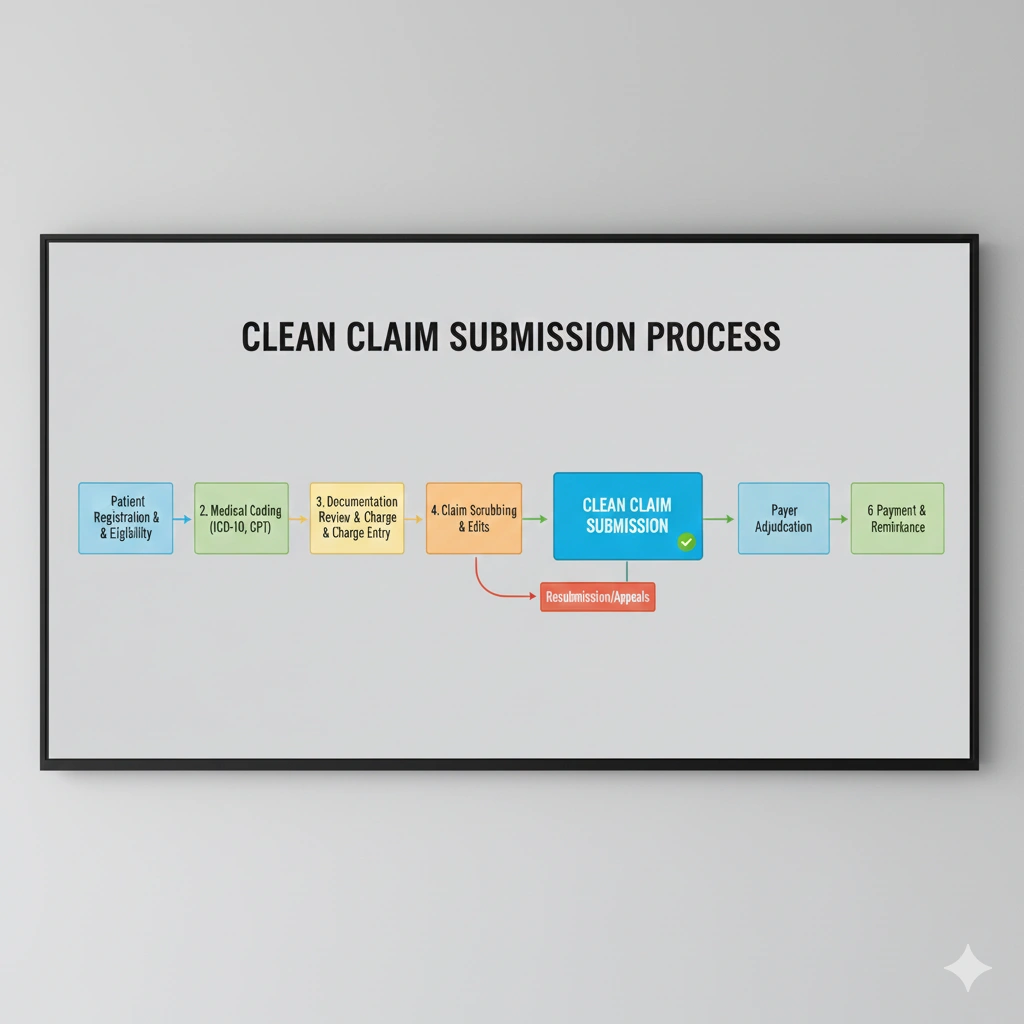

During this part of the first 90 days with a medical billing company, the goal is to submit clean claims consistently.

Early Signs of Progress

- Reduced claim rejections

- Faster payer responses

- Fewer billing errors

- Improved documentation feedback

Improved Communication & Reporting

By the second month, communication becomes structured.

You Can Expect

- Weekly or bi-weekly status updates

- AR (Accounts Receivable) reports

- Denial analysis summaries

- Payment posting transparency

Clear reporting is a major benefit during the first 90 days with a medical billing company, helping providers track progress with confidence.

Phase 3: Days 61–90 – Stabilization & Performance Growth

The final phase focuses on consistency and measurable outcomes.

What Changes in Days 61–90

- Faster reimbursement cycles

- Stable cash flow patterns

- Improved net collection rates

- Lower AR days

- Better payer compliance

By now, your billing process is no longer reactive—it’s strategic.

This phase completes the first 90 days with a medical billing company by setting long-term benchmarks.

How Cash Flow Improves Over the First 90 Days

Typical Improvements

- Claims submitted on time

- Denials followed up aggressively

- Underpayments identified

- Old AR actively worked

Many practices see noticeable financial improvement between days 60 and 90.

Common Challenges You Might Face (And Why They’re Normal)

Even the best transitions have hurdles.

Common Issues

- Learning curve for staff

- Initial backlog cleanup

- Adjusting documentation habits

- Temporary billing delays

These challenges are part of the first 90 days with a medical billing company and usually resolve quickly with collaboration.

Your Role During the First 90 Days

To get the best results, providers should:

- Respond quickly to billing queries

- Follow documentation guidelines

- Attend review calls

- Share feedback openly

A strong partnership accelerates success.

Key Metrics to Track in the First 90 Days

Important KPIs

- Days in AR

- Clean claim rate

- Denial rate

- Net collection percentage

- Revenue per visit

Tracking these metrics confirms whether the first 90 days with a medical billing company are delivering results.

Long-Term Benefits Beyond 90 Days

Once the initial phase ends, practices often enjoy:

- Predictable revenue

- Reduced administrative stress

- Better compliance

- Improved patient billing experience

The first 90 days are just the beginning.

Frequently Asked Questions

Q1: Is it normal for billing to slow down initially?

Short Answer: Yes. Setup and audits during the first month are necessary for long-term accuracy.

Q2: When will I see revenue improvement?

Short Answer: Most practices see improvement between days 60–90.

Q3: Do I still need in-house billing staff?

Short Answer: Some practices retain staff for front-end tasks while outsourcing claims and AR.

Q4: How involved should I be?

Short Answer: Active involvement during the first 90 days leads to faster success.

The first 90 days with a medical billing company are about building trust, accuracy, and efficiency. While early adjustments are normal, the long-term rewards include better cash flow, fewer denials, and peace of mind.

With clear communication and collaboration, this transition becomes one of the smartest decisions a healthcare practice can make.

Author: Mangesh

Last Updated: December 2025

Category: Medical Billing & Healthcare Management

Follow Us: facebook.com | instagram.com | linkedin.com | BackBoneDataSolutions.com