Property taxes can feel overwhelming—especially when homeowners believe their property has been overvalued. This is where Home Appraisal and Property Tax Appeals play a crucial role. A professionally conducted home appraisal provides factual, market-based evidence that can significantly influence the outcome of a tax appeal.

In this guide, we’ll explain how home appraisals impact property tax assessments, how they support appeals, and why homeowners increasingly rely on appraisal reports to ensure fair taxation.

Understanding Property Tax Assessments (Quick Overview)

Property tax assessments are conducted by local authorities to determine how much tax a homeowner must pay annually. These assessments are often based on mass-valuation models, not individual property inspections.

What Is a Home Appraisal and Why It Matters for Tax Appeals

A home appraisal is an independent, professional evaluation of a property’s market value. Unlike tax assessments, appraisals involve detailed inspections and recent market data.

Why Appraisals Matter

- Reflect current market conditions

- Consider property condition and upgrades

- Use verified comparable sales

- Provide documented valuation reports

For Home Appraisal and Property Tax Appeals, this accuracy is critical.

Why Property Tax Assessments Are Often Incorrect

Many homeowners are surprised to learn that tax assessments can be inaccurate. Common reasons include:

- Outdated market data

- Area-wide valuation methods

- Ignoring property damage or depreciation

- Overestimating neighborhood value growth

These gaps make Home Appraisal and Property Tax Appeals a practical solution for correcting errors.

How a Home Appraisal Supports Property Tax Appeals

A strong appraisal report is often the most persuasive evidence during a tax appeal.

Key Ways Appraisals Help

- Establish true fair market value

- Highlight differences from assessor’s data

- Provide professional, third-party credibility

- Strengthen legal appeal documentation

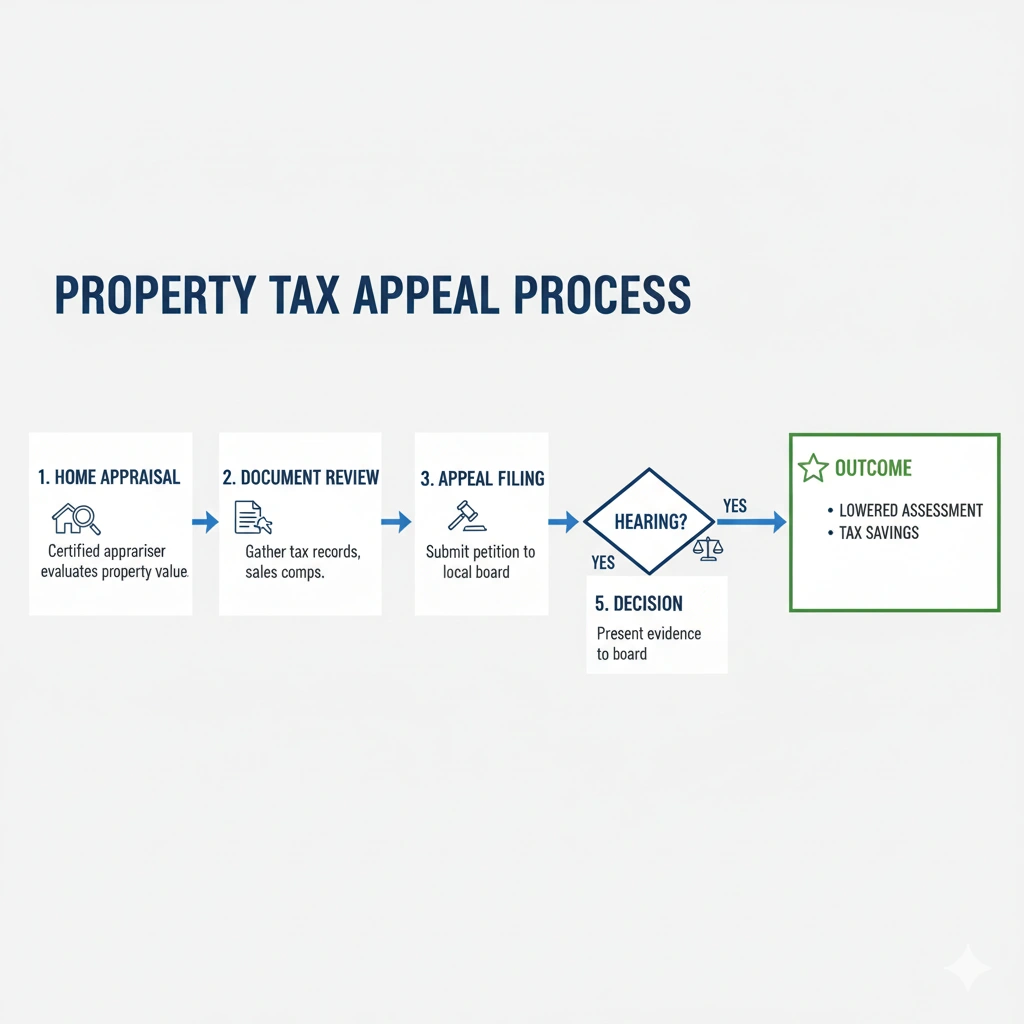

The Step-by-Step Role of Appraisals in Tax Appeals

1. Property Is Assessed

Local authorities assign a taxable value.

2. Homeowner Disagrees

Assessment appears higher than market value.

3. Professional Appraisal Is Ordered

Certified appraiser evaluates the property.

4. Appeal Is Filed

Appraisal report is submitted as evidence.

5. Decision Is Made

Tax authority reviews appraisal and reassesses value.

This process highlights why Home Appraisal and Property Tax Appeals are closely connected.

What Appraisers Focus on During a Tax Appeal Appraisal

When conducting an appraisal specifically for tax appeals, appraisers pay close attention to:

- Recent comparable sales (comps)

- Property condition and age

- Structural issues or defects

- Location disadvantages

- Market trends

These details strengthen Home Appraisal and Property Tax Appeals cases.

Comparable Sales and Their Impact on Appeals

Comparable sales are one of the most influential elements in an appraisal report.

Why Comps Matter

- Show actual selling prices

- Reflect buyer behavior

- Counter inflated assessments

- Support factual valuation arguments

In Home Appraisal and Property Tax Appeals, strong comps often decide the outcome.

When Should Homeowners Consider an Appraisal for Tax Appeals

Homeowners should consider an appraisal if:

- Property taxes rise sharply

- Market values decline

- Home has condition issues

- Comparable homes sell for less

- Assessment doesn’t reflect reality

Timing matters—most Home Appraisal and Property Tax Appeals must be filed within strict deadlines.

Benefits of Using a Professional Appraisal for Tax Appeals

Key Benefits

- Lower annual property taxes

- Long-term savings

- Accurate valuation records

- Strong legal support

- Peace of mind

For many homeowners, Home Appraisal and Property Tax Appeals lead to measurable financial relief.

Common Mistakes to Avoid During Property Tax Appeals

Avoid these common mistakes:

- Relying only on online estimates

- Missing appeal deadlines

- Using outdated appraisals

- Submitting incomplete reports

- Ignoring professional advice

A properly executed Home Appraisal and Property Tax Appeals strategy avoids these issues.

FAQs

1. Can a home appraisal really lower property taxes?

Short Answer: Yes. A credible appraisal can prove overvaluation and lead to reduced taxes.

2. How often can I appeal property taxes?

Short Answer: Most jurisdictions allow annual appeals, depending on deadlines.

3. Is an appraisal mandatory for tax appeals?

Short Answer: Not always, but it significantly strengthens Home Appraisal and Property Tax Appeals.

4. Who pays for the appraisal?

Short Answer: The homeowner, but savings often outweigh the cost.

Property taxes should be fair and accurate. When assessments miss the mark, Home Appraisal and Property Tax Appeals give homeowners a professional, data-driven way to challenge inflated values.

A reliable appraisal doesn’t just support your appeal—it protects your long-term financial interests.

Author: Mangesh

Last Updated: December 2025

Category: Home Appraisal & Property Tax

Follow Us: facebook.com | instagram.com | linkedin.com | BackBoneDataSolutions.com