Table of Contents

Real Estate Appraisal Companies or Property Tax Assessments

Property taxes affect homeowners, investors, and businesses every year. But behind those tax numbers is a detailed, data-backed process carried out by expert Real Estate Appraisal Companies. These companies play a crucial role in ensuring accurate Property Tax Assessments, fair valuations, and compliance with local regulations.

In this blog, we break down how these appraisal companies support taxation systems, why accuracy matters, and how modern technology is transforming valuation methods. Real Estate Appraisal Companies or Property Tax Assessments

What Are Property Tax Assessments?

Property tax assessments determine how much a property owner must pay based on the value of their real estate. Local governments rely heavily on these taxes for essential services such as:

- Public infrastructure

- Local schools

- Safety and emergency services

- Community development

How Real Estate Appraisal Companies Support Property Tax Assessments

1. Providing Accurate Market Value Reports

Real Estate Appraisal Companies evaluate the fair market value using:

- Sales comparison

- Cost analysis

- Income-based approaches

- Neighborhood and condition reviews

Accurate valuations ensure homeowners are not overcharged or undercharged. This reduces disputes and maintains taxation fairness.

2. Ensuring Compliance With Local and Federal Standards

Property tax assessment requires adherence to strict regulations like:

- USPAP (Uniform Standards of Professional Appraisal Practice)

- State-specific taxation laws

- Municipal requirements

Appraisal companies ensure every valuation is audit-ready and defensible.

3. Conducting In-Depth Property Inspections

Appraisers perform physical or digital inspections to examine:

- Structure condition

- Improvements or renovations

- Lot size and zoning

- External influences (noise, surroundings, road access)

These inspections form the foundation of accurate tax assessments.

4. Offering Reassessment and Review Services

Real Estate Appraisal Companies assist in re-evaluations when:

- Property owners contest tax bills

- Market conditions change

- Major renovations occur

Their independent reports strengthen appeals and support fairness.

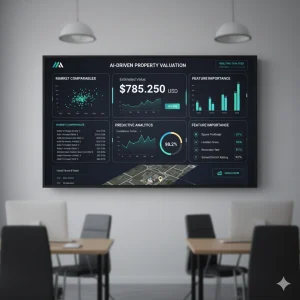

5. Using Advanced Technology and Data Analytics

Modern appraisal companies use:

- AI-driven valuation models

- Automated valuation tools (AVMs)

- MLS (Multiple Listing Service) data

- Geographic Information Systems (GIS)

- Drone imagery

Technology enables faster, more accurate, data-backed property tax assessments.

6. Supporting Local Governments with Bulk Appraisal Projects

Cities and counties often require mass appraisal for thousands of properties at once. Appraisal companies help by:

- Conducting large-scale property reviews

- Providing standardized valuation models

- Delivering compliant and transparent reports

This supports taxation systems and reduces administrative workload for local authorities.

7. Reducing Errors and Preventing Overassessment

Incorrect assessments may lead to:

- Excessive tax burden

- Homeowner dissatisfaction

- Legal disputes

Real Estate Appraisal Companies improve accuracy and protect owners from unfair tax obligations.

Why Accuracy in Property Tax Assessments Matters

Benefits for Homeowners and Businesses

- Fair taxation

- Reduced penalties

- Prevention of overpayment

- Higher transparency

Benefits for Governments

- Stable revenue generation

- Better budgeting

- Improved public trust

How Property Owners Can Benefit from Professional Appraisal Support

Real Estate Appraisal Companies offer services like:

- Independent second opinions

- Tax dispute assistance

- Detailed valuation breakdowns

- Comparable market analysis

These services empower property owners with clarity and confidence.

Common Myths About Property Tax Assessments – Busted

Myth 1: Property taxes always increase when market prices rise.

Fact: In many regions, tax caps and limits apply.

Myth 2: The assessor and appraiser perform the same job.

Fact: Assessors calculate taxes; appraisers determine unbiased market value.

Myth 3: Renovations always increase taxes.

Fact: Only structural improvements typically impact tax value.

FAQ Section

1. Do Real Estate Appraisal Companies directly decide tax amounts?

Summary:

No. They provide valuations, but local authorities determine the tax rate.

2. Can an independent appraisal reduce my property tax bill?

Summary:

Yes. If your property is overassessed, an accurate appraisal supports appeals.

3. How often are property tax assessments conducted?

Summary:

Most regions reassess annually or once every few years depending on law.

4. Are AI tools accurate in property appraisals?

Summary:

AI improves speed and accuracy, but certified appraisers always verify results.

Real Estate Appraisal Companies or Property Tax Assessments play a vital role in ensuring fair, transparent, and accurate Property Tax Assessments. From advanced valuation techniques to regulatory compliance and appeal support, their work directly affects homeowners, businesses, and local government revenues. Real Estate Appraisal Companies or Property Tax Assessments

With technology and AI making valuations faster and more precise, the future of property tax assessments is evolving — and appraisal companies are at the center of this transformation.

📌 Author Info

✍️ Author: Mangesh

📅 Last Updated: November 2025

📂 Category: Real Estate Appraisal / Property Tax

🔗 Follow Us: facebook.com | instagram.com | linkedin.com | BackBoneDataSolutions.com